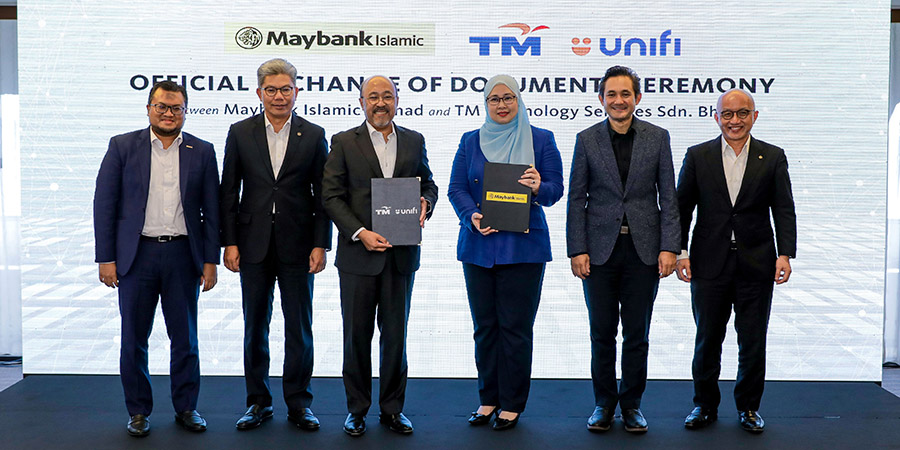

Telekom Malaysia (TM) has partnered with Maybank Islamic Berhad to launch the country’s first 5G- powered Islamic Banking as a Service (BaaS) solution to deliver seamless access and experiences to digital clients, particularly micro, small, and medium-sized enterprises (MSMEs).

Deploying 5G in Banking to Support MSMEs

The partnership is expected to deliver a digital banking experience that is both one-of-a-kind and inclusive to all customers by combining the wide range of financial services offered by Maybank Islamic Berhad with the mobile packages offered by TM's UNI5G Postpaid Biz.

Unifi Business, TM’s digital business solutions arm, has also launched ‘Go Niaga'— a 5G-enabled mobile banking bundle that aims to help companies with budgeting, revenue generation, and the provision of secure digital payment alternatives.

Shanti Jusnita Johari, Chief Commercial Officer for Consumer Strategy & Business at Unifi, recognized the importance of supporting MSMEs; thus, the partnership will address the challenges experienced by local businesses in accessing financial services.

“This partnership is the next milestone in our vision to become a digital powerhouse by 2030 and our mission to power a ‘Digital Malaysia,’ improving businesses and communities through technology, and paving the way for a digitally inclusive nation,” Johari said.

Accelerating Financial Inclusion in Malaysia

Furthermore, the ‘Go Niaga’ bundle is expected to address the market gap in the local market to better engage in e-commerce and reach a wider audience.

Dato’ Mohamed Rafique Merican, Maybank Islamic Berhad’s CEO, highlighted the importance of the partnership in accelerating financial inclusion in Malaysia.

“While the technology originates from the BaaS concept, what makes it unique is its adherence to Islamic principles, making it the pioneering example of its kind in Malaysia. It combines modern technology with the ethical requirements of Islamic finance, providing innovative and faith-based financial services.”

The partnership showcases TM’s commitment to promoting a ‘Digital Malaysia,’ where innovations in technology serve as a driving force for positive transformation. The availability of critical financial tools, powered by a secure 5G network, allows underserved individuals and MSMEs to actively participate in Malaysia’s digital transformation and fosters financial inclusion.